If you’re gearing up to write a Horizon Europe proposal, you already know how crucial the budget is. But did you know Horizon Europe uses two different funding models for project budgets?

In fact, the European Commission now offers traditional actual cost grants alongside newer lump sum grants. A well-structured budget doesn’t just add up the euros; it tells evaluators that you have a realistic plan to deliver results. Understanding these models and their commonalities and differences can make or break your proposal.

In this comprehensive guide, we’ll demystify actual vs. lump sum Horizon Europe grants, bust some myths (no, lump sums aren’t “free money” without oversight!), and give you practical tips to build a winning budget. By the end, you’ll be empowered to handle either model with confidence and Future Needs will be right by your side as your expert partner in EU budgeting success.

What Are Actual Cost vs. Lump Sum Grants in Horizon Europe?

Horizon Europe, the EU’s flagship research & innovation program, uses different forms of grants to fund projects. The two most common are actual cost grants and lump sum grants:

- Actual Costs Grant: This is the classic funding model you might know from past programs. The grant amount is based on the actual expenses incurred during the project, subject to eligibility rules. You budget by estimating all the costs for your project (personnel, travel, equipment, etc.), and after winning the grant, you claim reimbursements for each cost with proof. Think of it as the EU “refunding” your project’s bills. For example, if you spend €50,000 on a researcher’s salary and €5,000 on lab supplies, you report those costs and get them covered (usually 100% for research action grants). This model demands detailed documentation and follows strict rules – costs must be linked to the project, reasonable, and recorded in your accounts. It’s the default mode in many calls and was the only option in previous programs like Horizon 2020.

- Lump Sum Grant: This is a newer, simplified model. Instead of reimbursing every receipt, the European Commission agrees to pay a fixed total amount for the project, divided into lump sums per work package (or per deliverable/milestone). You still propose a budget and breakdown, but payment is not based on actual spend. It’s based on outputs. If you complete the tasks in Work Package 1 as promised, you get the pre-set sum for WP1, regardless of whether you spent a bit more or less doing the work. In other words, as long as you deliver results, the EU doesn’t ask how you spent the money. This model was piloted under Horizon 2020 and shown to significantly reduce administrative burden while maintaining focus on outcomes, especially for SMEs and newcomer organisations. The Commission explicitly cites lump sums as a key tool for error reduction and simplification, shifting attention from financial management to scientific and technical performance. (ec.europa.eu) More recent implementation data (up to mid‑2024) indicate that lump sum mechanisms are increasingly embedded across many Horizon Europe calls, many topics now offer or require lump sum funding, reflecting a strategic move by the EU to streamline project administration without compromising accountability (ec.europa.eu)

It’s important to note you don’t get to choose the model freely. Each call for proposals will state whether it uses actual costs or lump sum. For example, a call might be titled “XYZ (Lump Sum Pilot)” indicating it’s lump sum. The good news is that whichever model you encounter, the proposal structure and evaluation criteria remain largely the same. The Commission will still check that your budget is adequate and reasonable for the work planned. In fact, planning a budget for either model starts with the same step: outline all the resources you need and ensure they align with your work plan.

Common Ground: How Both Funding Models Are Similar

Before diving into the differences, let’s reassure you that actual cost and lump sum grants have more in common than you might think. Both are mechanisms to fund the exact same project activities, and both require thorough budgeting and justification in the proposal.

- Project Planning: In both models, you must carefully plan your project’s work packages, deliverables, and required resources. You’ll use the same cost categories to estimate your needs: personnel, travel, equipment, subcontracting, other direct costs, etc. The European Commission expects lump sum budgets to follow the same eligibility rules as actual costs budgets (ec.europa.eu). This means you can’t pad a lump sum with ineligible expenses if a cost wouldn’t be eligible for reimbursement, it shouldn’t be in a lump sum budget either. Practically, when writing the proposal Part B (the narrative), both models require a full budget justification explaining why you need X person-months or Y euros for a given task. There’s no escaping good old homework on calculating costs!

- Proposal Structure: Horizon Europe proposals are split into Part A (forms) and Part B (narrative) in the submission system. This doesn’t change with the funding model. In an actual cost grant, Part A includes a budget table that lists each partner’s costs by category (with indirect costs added automatically). In a lump sum grant, Part A’s budget table is simplified to just show each partner’s lump sum share. But in both cases, Part B remains the same: you have Section 3.1 of your proposal dedicated to the budget, explaining and justifying the resources for each work package. So either way, you’ll be writing about your budget in the text, linking it to your work plan, and convincing evaluators it’s sound.

- Payment Schedule: Both funding schemes follow the typical Horizon Europe payment scheme. This means you get a pre-financing (advance) payment after the grant agreement is signed, then usually one or more interim payments (after periodic reports), and a final payment at the end. The timing of reports and payments is defined in the grant agreement for both models. The difference lies in how the amounts of those interim/final payments are calculated (we’ll get to that), but structurally, you still have to submit reports to trigger payments. So, a lump sum project doesn’t mean “we’ll pay everything upfront”, it adheres to the same disciplined schedule with a few main payment points.

- Accountability: Ultimately, both models hold you accountable to deliver what you promised. A Horizon Europe project is judged on outcomes and proper use of funds. With actual costs, the accountability is both financial and technical, therefore, you must spend funds on eligible things and do the work. With lump sums, the accountability is more heavily on the technical side, therefore, you must complete the work packages as described. Either way, if a project fails to perform (e.g., major deliverables are missed), the Commission has ways to take action (reduce the grant, etc.). In short, neither model is “easier” in terms of commitment to execute the project well.

So, if you’re good at budgeting and project management, those skills translate to both funding types. Many principles like “don’t wildly exceed typical costs without justification”, or “ensure your budget matches your work plan tasks” apply across the board.

Key Differences in Budgeting for Actual Costs vs. Lump Sum

Let’s get into the practical differences you’ll experience first at the proposal stage, and later during project implementation. The biggest divergence happens in how you plan and present the budget in the proposal.

1. Detailing Costs vs. Distributing a Lump Sum: In an Actual Costs proposal, you must detail every cost category per partner. The budget form in Part A will have columns for personnel, travel, equipment, etc. Each partner enters numbers in each category, for the whole project duration. For example, Partner 1 might request €300,000 personnel + €20,000 travel + €30,000 equipment + … etc. All partners’ costs then add up to the total project cost. The form will also automatically add 25% indirect costs on top of the eligible direct costs (except subcontracting) – this is the overhead every project gets to cover admin, utilities, office costs, etc. In Part B, you’d explain those numbers: maybe Partner 1 has 30 person-months of researchers (hence €300k), planned 5 trips to conferences (hence €20k travel), and needs a specialized equipment (hence €30k).

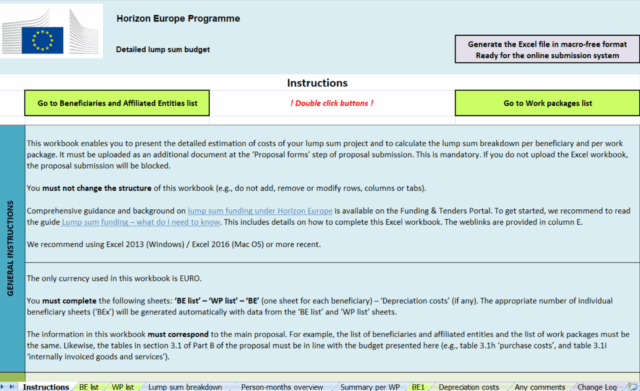

In a Lump Sum proposal, by contrast, the Part A form doesn’t show all those categories for each partner. Instead, it will typically just show a lump sum amount per partner. Essentially, you allocate, say, €1,000,000 total project budget across Work Packages and partners – e.g., WP1 €200k, WP2 €500k, WP3 €300k, and each WP’s total is split among the partners involved. You do not list how much of WP1 is personnel vs travel in the form. However – and this is crucial – you still have to do the math in the background. The Commission requires a Detailed Budget Table (Excel) as an annex for lump sum proposals, where you do break down the costs per category and per partner, to justify the lump sum. This Excel is not in the grant agreement, but evaluators use it to check that your lump sum request is reasonable (they will verify that you followed the eligibility rules and that your figures aren’t plucked from thin air (ec.europa.eu). The Excel introduces the concept of “cost items”, you might list, for instance, 10 travel trips at €500 each under WP2, 100 person-months at €5,000 each, etc., and it sums up to your lump sum.

In short: Actual cost budgeting is like building the project budget line by line in the proposal itself. Lump sum budgeting is like building the budget in an Excel offline, then just showing the summed-up chunks in the proposal. The internal effort to calculate a sound budget is similar, but the way it’s presented differs.

2. Flexibility in Budget Allocation: During proposal preparation, if you realize you need to adjust costs, the actual cost model is a bit more granular: you might tweak one category for one partner. In lump sum, you’d adjust the distribution per work package or partner lump sum share. Some applicants feel lump sum budgets are rigid because once you fix a lump amount per work package, it’s not easy to change during grant agreement prep (the EU evaluators might suggest changes if something looks off, but there’s no standard negotiation to rework budgets; Horizon Europe has a no-negotiation principle). With actual costs, if something is high, evaluators might just cut that cost or ask for clarification, but the final grant agreement budget still lists categories you can move between somewhat. With lump sums, the grant agreement will lock in the lump sum per work package, becoming a fixed price for that chunk of work.

3. Part A vs. Part B emphasis: In actual cost proposals, Part A’s numbers themselves matter a lot (since that’s what gets funded and later reimbursed). In lump sum proposals, Part A’s numbers (the lump sums per WP) matter, but Part B narrative carries extra weight to assure evaluators that those lump sums are well-justified. Practically, you might use Part B to detail each work package’s resource needs: “WP2 – 50 person-months, €50k travel, €100k equipment… resulting in a €500k lump sum.” So, there’s an argument that lump sum proposals need even more storytelling in the budget justification, because you’re not showing the category breakdown in the official form. You must convince evaluators that, for example, WP2 truly needs €500k by describing the tasks, team, and resources.

How Does Project Reporting and Auditing Differ?

The real test of actual vs lump sum comes during project implementation: how you report progress and how compliance is monitored.

In Actual Cost grants: Every reporting period (typically every 12-18 months), you submit a Periodic Report. This has two parts: a Technical Report (describing work done, results, deliverables achieved) and a Financial Report (cost claim). The financial report is essentially a collection of Financial Statements from each partner, listing all costs incurred in that period, broken down by category. You must report actual numbers spent on salaries, travel, equipment, etc., and those are subject to eligibility checks. The EU project officers and possibly external reviewers will scrutinize these financial statements to ensure costs adhere to the rules. They might question unusual costs or ask for justification during the review.

At the end of the project (or even during, randomly), some partners might be picked for audit. In Horizon Europe, if a partner’s total requested funding exceeds €430,000, they will need to provide an audit certificate (CFS) from an external auditor. In an audit, you’ll need to show documentation for all claimed costs – payslips, invoices, timesheets, purchase orders, etc. Essentially, actual cost projects require proof for every euro. If an auditor finds, say, an ineligible expense (maybe a cost claimed that wasn’t in the project’s scope or lacked an invoice), that amount can be rejected and the grant reduced by that amount.

In Lump Sum grants: The periodic reporting is simpler. You still do the Technical Report (you describe progress, results, deviations, etc.). But the Financial Report in a lump sum project does not list any costs. There is no “I spent €X on travel” section. Instead, the coordinator simply declares which work packages (or parts of them) have been completed in that period. The report might include a table of work packages and a checkbox or percentage indicating completion. If WP1 and WP2 are completed and were allocated €200k and €500k respectively, then €700k is considered “achieved” and will be approved for payment.

No receipts required. In fact, the European Commission clearly states that beneficiaries in lump sum grants “do not have to report actual costs and there are no financial declarations to be made nor reviewed”. This is because lump sum grants remove the obligation to submit detailed cost reports, there is simply no contractual requirement to keep financial records or report expenditures; the focus is instead on the technical completion of work packages (ec.europa.eu). That means you don’t need to keep invoice files to send to Brussels. And the traditional financial audit, checking accounts and documentation, is largely eliminated (ec.europa.eu). The European Commission states that in Horizon Europe lump‑sum grants “there is no report of actual costs, and there are normally no financial checks, reviews or audits”. Instead, audits and controls focus on whether the work packages were implemented properly, not on verifying individual expenses such as invoices or timesheets (ec.europa.eu 1, ec.europa.eu 2).

Download the Lump Sum Budget File Template

This shift has huge implications:

- Admin Burden: Lump sum projects drastically cut the administrative burden during the project. Project managers don’t have to chase partners for receipts or worry about assembling financial reports. You still need an internal budget tracking (because you don’t want to run out of money), but you won’t report that to the EU. Actual cost projects require significant admin time for reporting and auditing preparation.

- Financial Flexibility: In actual cost grants, you must spend roughly according to the categories and plan if you need to move a lot of money between categories or partners, you might need an amendment or at least an explanation. In lump sums, since you’re not reporting categories, you have internal flexibility. You can overspend in one category and underspend in another as needs evolve, without notifying the EU, as long as you still complete the WP within the lump sum amount. In the words of the European Commission: “You can use the budget as you see fit as long as the project is implemented as agreed”, the Commission does **not monitor how you allocate spending internally, as long as deliverables are delivered on time and per plan (ec.europa.eu). This is a big plus. Why? Because you can adapt the budget to reality (say travel ended up costing more, equipment less) easily. However, note: if changes are so large that you can’t complete a WP with the initial allocation, that’s a problem – the lump sum is fixed.

- Risk and Accountability: Lump sum grants inherently shift financial risk onto beneficiaries. In an actual cost grant, if you complete the agreed work and incur valid expenses, even if some tasks fall short on KPIs promised, you still get reimbursed for the costs you incurred. In contrast, under the lump sum model, the European Commission pays only upon successful completion of defined work packages. If a work package (WP) isn’t fully delivered, the related lump sum may be withheld or only partially paid (op.europa.eu). Since payment hinges entirely on WP delivery—not on receipts or cost claims—the consortium bears the risk collectively. One partner’s failure can affect the entire WP’s payout, which is why strong project coordination and clear internal agreements are essential in lump sum consortia (op.europa.eu, ec.europa.eu).

- Audits: The audit burden relief under lump sum grants is one of the biggest advantages, especially for organisations that fear the complexity and stress of EU financial audits. The European Commission confirms that lump sum models remove the need for detailed financial reporting and ex‑post audits, because actual costs are no longer reported as part of the grant structure (ec.europa.eu). Instead, checks and reviews focus solely on technical implementation, ensuring that work packages are delivered as agreed, not on verifying invoices, timesheets, or cost categories (ec.europa.eu). Beneficiaries do still need to follow national accounting laws, and keep basic documentation (e.g. lab notes or internal timesheets) as evidence of activity, but this is purely for internal or exceptional purposes, not for EU cost justification. In short, lump sum grants deliver significant administrative relief and reduce the risk of financial corrections or funding repayments due to minor accounting errors without sacrificing accountability over project outcomes.

Pros and Cons of Each Model

Both models have their champions and critics. Let’s break down the pros and cons in practical terms:

Actual Costs – Pros:

- Familiarity & Incremental Payments: This model is familiar to anyone who has managed grants before you spend money as needed and get reimbursed. If a project encounters difficulties, you at least receive funding for the work done and costs incurred up to that point. There’s a sense of “safety net” in that as long as you followed the rules in spending, you won’t lose funding due to unmet goals (provided you did the work in good faith).

- Flexibility during project: You can often adjust your spending within the approved budget. For example, you budgeted €100k for equipment but realized you need only €80k, you could spend the extra €20k on more personnel time or additional experiments (with proper justification). The grant agreement budget isn’t micro-managed at the level of each line item as long as costs are eligible and support the project, you have leeway. And if needed, formal amendments can shift budget between partners or categories.

- Adjusts to Reality: If prices go up or you need an extra trip, you can do it and claim it (within the budget limits). You’re not stuck with a fixed sum that might prove too low. Also, if a partner drops out or is underperforming, you might transfer tasks and their budget to someone else via an amendment the grant can adapt.

Actual Costs – Cons:

- Heavy Administrative Load: The actual cost model may feel familiar, but it comes with a significant administrative burden. You must meticulously track every receipt, timesheet, purchase order, or equipment depreciation. Many beneficiaries—especially SMEs or first‑time applicants—struggle with this complexity. The European Commission has reiterated that the actual costs model is error‑prone, and these high error rates were a key driver behind its shift toward simplified funding options such as lump sums and unit costs in Horizon Europe. This change aims to broaden access and reduce financial mistakes, especially for newcomers or smaller organisations with lower administrative capacity (ec.europa.eu)

- Audit Risk and Stress: The possibility of audits and the fear of having to possibly repay funds (if an auditor finds something wrong) is a big downside. It forces a very conservative approach sometimes (partners might avoid certain useful expenses just because they’re unsure if it’ll be eligible). For small players, the audit process itself can be daunting.

- No reward for efficiency: If you manage to do the work cheaper than budgeted, you only get reimbursed what you spent. You cannot reallocate saved money to other work without approval, and any budget left unspent is just money that stays with the Commission. There’s little incentive to economize; in fact, some worry it encourages “use it or lose it” spending towards project end.

Lump Sum – Pros:

- Administrative Simplicity: This is the headline benefit. No financial reporting means your focus can stay on the science/technical work and coordination. Especially for partners without big finance departments, this is a relief. The time saved can be weeks or months of work over a project’s life.

- Lower Audit Probability: Because there are “no financial checks and audits” by design (ec.europa.eu) the consortium can breathe easier. The project won’t face a detailed financial audit in most cases. (The EU could audit to check the work was done, but that is usually straightforward to show via deliverables and documentation of results).

- Autonomy and Internal Flexibility: You get to manage the project budget internally. If one task needs more resources, you can allocate more of your internal budget to it (provided you still complete everything). The Commission doesn’t need to be informed of budget shifts between cost categories or between partners (unless you formally reallocate lump sum shares between partners or WPs, which might require an amendment). The key is that the EU doesn’t monitor the cost details, so the consortium has freedom to optimize use of funds. Some teams might, for example, repurpose travel budget savings to buy extra consumables in a lump sum project, that’s fine and requires no permission.

- Encourages Outcomes & Efficiency: Lump sum grants can incentivize teams to work efficiently. If you complete the work under budget, you still get the full lump sum effectively you “gain” the savings (those can be reallocated to additional work on the project or improving quality, since the money is already granted for that WP). This can be a motivator to avoid wasteful spending. And since payment is not tied to costs, consortia might plan more carefully to ensure each work package is scoped realistically.

Lump Sum – Cons:

- Planning Overhead: The flip side of no reporting during the project is more work at the proposal stage. You must think through every cost in advance and get the lump sum budgets right. The required detailed budget spreadsheet can be quite complex. You also might need to justify costs more rigorously to evaluators (because they can’t see categories at a glance, they have to trust your explanation and the spreadsheet). This front-loaded effort can be challenging, especially for less experienced applicants who may not know how to estimate costs accurately.

- Rigid Grant Agreement: It’s important to note: neither lump sum nor actual cost projects allow you to claim more than what’s been granted as a total payment. If your project ends up costing more than anticipated, the EU won’t cover the extra, regardless of budget model. That said, the difference with lump sums is in how rigid the structure is once the grant is signed. In lump sum grants, the amounts allocated per work package are fixed in the Grant Agreement. If you under-budgeted WP2 and it turns out to require more effort or cost than expected, you can’t move money into it from another WP without a formal amendment, and even then, changes are limited and need strong justification. In most cases, the consortium absorbs the shortfall. This is different from actual cost projects where, while the total grant remains capped, there’s usually more internal flexibility in reallocating resources across categories or tasks, as long as costs remain eligible and properly justified. With lump sums, that flexibility is lost once work package allocations are locked in. In short: the budget is final. That’s not unique to lump sums but the way it’s enforced makes planning accuracy even more critical under this model.

All-or-Nothing Payment per WP: This is a big one: if a work package isn’t fully done, the EU can hold payment. They may pay pro-rata in some cases if a WP is, say, 80% done at project end, but that’s discretionary and complex. So, the consortium bears the risk of any partner failing to deliver. This joint liability means you need strong project management and possibly contingency plans. It can also cause cash flow issues: imagine one WP is delayed, then the interim payment for that WP is delayed until it’s done in the next period (ec.europa.eu). Partners expecting money might have to wait longer.

How do you prepare effectively for the model your call topic specifies?

If it’s lump sum, that means investing more time upfront:

- Build your internal budget like you would for actual costs (personnel, travel, etc.)

- Translate it into lump sum logic by allocating totals to work packages

- Use the EC’s lump sum Excel template to estimate cost items

- Align work package structure with funding logic, avoid bundling too much into one WP

- Tighten coordination: if one WP underdelivers, payment can be withheld for the whole thing

If it’s actual cost, prepare to manage the admin load during implementation:

- Detailed timesheets, receipts, and financial reports are required

- You’ll be audited on eligible costs so your documentation has to be airtight

- There’s flexibility to adapt spend as long as it stays eligible and justified

In either case, the budget model shapes how you plan, report, and manage risk. But it doesn’t determine the value of your idea or your chance of success. What matters most is building a solid, fundable plan aligned with the rules of the call.

FAQ: Horizon Europe Budgeting – Actual Costs vs Lump Sum Grants

1. What is the difference between Horizon Europe lump sum and actual cost grants?

Actual cost grants reimburse you based on real expenses you’ve incurred (e.g., salaries, equipment, travel), backed by detailed documentation. In contrast, lump sum grants pay a fixed amount for completing work packages, regardless of what you actually spent. You still estimate costs during the proposal, but once approved, you’re paid for outputs, not receipts.

2. Do Horizon Europe lump sum grants require financial reporting?

No. With lump sum funding, there’s no requirement to submit financial reports or timesheets. You report only on which work packages were completed, and the European Commission disburses payment based on that. However, you must still deliver your project as agreed, and audits may verify technical delivery.

3. How do I build a budget for a Horizon Europe lump sum grant?

Start by preparing your internal budget like you would for an actual cost grant, estimating personnel time, travel, equipment, subcontracting, etc. Then translate those figures into lump sum allocations per work package using the EC’s Lump Sum Budget Table. While you won’t report these costs later, evaluators still assess them upfront to ensure your lump sum estimates are realistic and justified.

4. What happens if a work package is not fully completed in a lump sum project?

If a work package is incomplete, the corresponding lump sum may not be paid. The EU can assess partial completion at the final review, but there’s no guarantee of pro-rata payments. This means all partners involved in that work package share the risk. Careful planning and internal coordination are essential to avoid losing funding.

5. Is the payment schedule different for lump sum grants?

The schedule (pre-financing, interim, and final payments) is the same as in actual cost grants. What changes is how payments are triggered. For actual costs, you’re reimbursed for reported eligible expenses. In lump sum grants, you’re paid based on completed work packages, regardless of actual spend.

6. How does pre-finanacing work in lump sum grants in Horizon Europe?

Pre-financing for lump sum grants in Horizon Europe depends on the number of reporting periods:

- One reporting period: typically 80% of the total lump sum.

- Two or more: typically 160% of the average lump sum per period (i.e. lump sum ÷ number of periods × 160%).

A small part is withheld for the Mutual Insurance Mechanism. The grant agreement sets the amount, and the coordinator distributes it as per the consortium agreement.

7. When can payments be suspended in Horizon Europe or Horizon 2020 lump sum grants?

Payments can be fully or partially suspended if beneficiaries breach the Grant Agreement (Article 28.1). Cost eligibility is not a reason for suspension in lump sum grants. Unaffected parts may still be paid, and any suspended final payment will close the action once resolved.

8. How can you tell if a Horizon Europe topic uses lump sum funding?

Lump sum funding is indicated in the “specific conditions” section of the topic in the work programme, under “Legal and financial set-up of the Grant.” It will state whether the lump sum is fixed (Type 1) or proposed by applicants (Type 2), and refer to the methodology used to set the amount.

9. How are periodic reports prepared for lump sum grants in Horizon Europe or Horizon 2020?

Periodic reports are submitted via the Grant Management System, similar to standard grants. However, for lump sum grants:

- The coordinator must indicate which work packages are ‘completed’ or ‘not completed’.

- The technical report must justify completed work packages; no ‘use of resources’ report is required.

- The financial report is simplified and largely automated based on completed work packages.

Need help navigating that? That’s exactly where our expert teams come in. For more information, you can book a session with our funding specialist at info@futureneeds.eu.

Follow us on LinkedIn to stay informed about the latest Horizon Europe and Erasmus+ developments and subscribe to our newsletter for expert highlights from the EU research and innovation landscape, delivered straight to your inbox.

About the authors

Anna Palaiologk, the founder of Future Needs, is a Research & Innovation Consultant with 18 years of experience in proposal writing and project management. She has worked as a project Coordinator and Work Package leader in 30+ EU projects and has authored 50+ successful proposals. Her research background is in economics, business development and policy-making. Email Anna at anna@futureneeds.eu.

Lina Giannivasili is an Innovation Project Manager with experience in proposal writing and project management across Horizon Europe’s Cluster 1: Health; Cluster 4: Digital, Industry & Space; Cluster 5: Climate, Energy & Mobility; and Research Infrastructures. Her background is in economics and gender equality, and she focuses on integrating these perspectives to strengthen the societal impact of EU-funded projects. Email Lina at lina@futureneeds.eu.

Lina Giannivasili is an Innovation Project Manager with experience in proposal writing and project management across Horizon Europe’s Cluster 1: Health; Cluster 4: Digital, Industry & Space; Cluster 5: Climate, Energy & Mobility; and Research Infrastructures. Her background is in economics and gender equality, and she focuses on integrating these perspectives to strengthen the societal impact of EU-funded projects. Email Lina at lina@futureneeds.eu.